Fire SME Takaful

Protect your business premises with our Fire SME takaful plan. Whether you’re running a small business or managing a larger operation, this plan is designed to provide comprehensive coverage that fits your needs and budget.

Basic Coverage

Our Fire SME insurance includes coverage for:

- Premise Rebuilding Cost: Covers the expenses needed to rebuild your business premises in case of damage.

- Content Replacement Cost: Ensures your business contents can be replaced if damaged.

Covered Incidents: Fire, Lightning, Explosion, Terrorism (up to 10% of Sum Covered).

Customizable Options

Option 1: Special Perils

Enhance your protection with additional coverage against specific risks that might require rebuilding your premises or replacing your business contents.

Option 2: Add-On

Add extra layers of protection for losses not covered under the Basic Coverage. Please note, Add-Ons must be attached to the Basic Plan and cannot be taken as standalone coverage.

Case Study

Here are some examples of businesses that can benefit from our Fire SME Takaful.

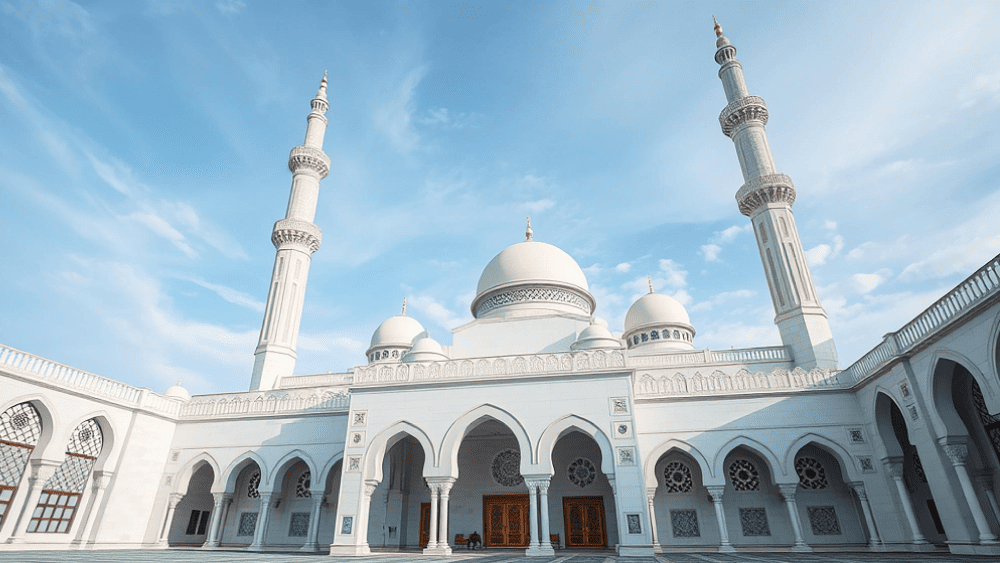

Masjid / Surau

A masjid in a bustling town recently installed a large ceiling fan to ensure a cool and comfortable prayer environment. One day, during a busy Friday prayer, a sudden electrical short circuit caused the fan to malfunction, emitting sparks that led to a small fire in the ceiling. The fire damaged the fan, lighting fixtures, and part of the roof structure. With the masjid's Fire SME Takaful, they quickly covered the Premise Rebuilding Cost to repair the ceiling and electrical wiring, while the Content Replacement Cost helped them replace the damaged fan and lighting. The swift action allowed the masjid to resume its activities with minimal disruption, ensuring the safety and comfort of its jemaah.

Restaurant

A family-owned restaurant in a popular dining area was suddenly flooded when a water pipe burst in the kitchen. The water quickly spread, causing significant damage to the kitchen equipment, flooring, and even seeping into the main dining area. Fortunately, the restaurant had opted for the Fire SME Takaful with Special Perils, which covered the costs to repair the water-damaged sections of the restaurant and replace essential kitchen appliances. This quick assistance allowed the restaurant to recover smoothly, reducing downtime and getting back to serving their customers in no time.

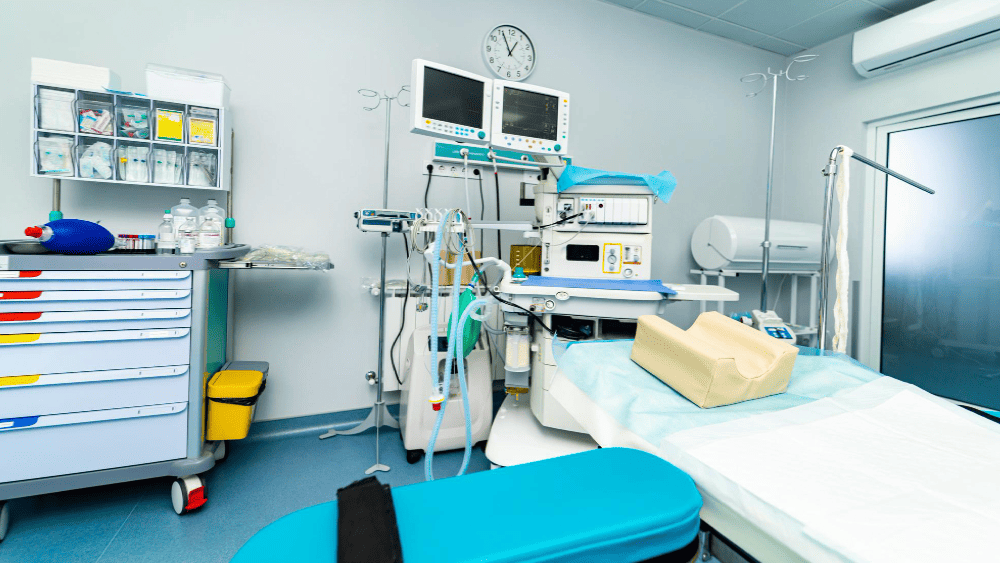

Clinic

A community clinic that served as the main healthcare provider for the neighborhood faced an unfortunate incident during a thunderstorm. A lightning strike caused a power surge that led to a fire, damaging medical equipment and parts of the clinic's interior. Thanks to their Fire SME Takaful, the clinic was able to utilize the Premise Rebuilding Cost to restore the damaged areas and the Content Replacement Cost to replace critical medical devices. This allowed the clinic to continue providing uninterrupted healthcare services to the community, even in the face of adversity.

Why Choose Fire SME?

Business-Friendly

Classified as an Operating Expense (OPEX), making it easier for businesses to manage.

Economical

Fire SME and all its Add-Ons are very economical for its contribution value per Benefit Covered

Add On Coverage

The Add-Ons cannot be taken as a Standalone Protection, but must be attached to the Basic Plan: Fire SME

For more details or to get a quote, click the button below to Whatsapp us.

Related Coverages

Looking for more ways to safeguard your business or organization? Check out these options: